Regional insights from the pan-European Smart Protein Project consumer survey

To be successful in the food industry, you need to know your consumers inside out. What do they want from their diet? How are their food choices and motivations changing, and do these changes differ by country? Should you adjust your business and products, and if so, in what ways? These questions are essential for maximizing sales and must be continuously monitored as consumer preferences evolve.

Fortunately, we can provide you with all the data you need. In March 2024, the Smart Protein Project published a series of country-specific reports, building on our comprehensive pan-European survey from November 2023.

These reports highlight distinct opportunities and challenges across various regions, providing stakeholders with detailed insights that reflect the unique market dynamics of each area. If you haven’t yet read the reports, access them here and dive deep into their valuable information to support strategic decision-making.

To bridge the gap between theoretical data and real-world applications, we hosted a series of webinars throughout April and May where we featured industry experts who shared their extensive knowledge and experience navigating the dynamic plant-based market.

Access the webinar recordings:

- April 22nd – Italy, Spain, and France

- April 25th – Poland and Romania

- April 30th – The Netherlands, Germany, and Austria

- May 2nd – The UK and Denmark

Each webinar was designed to turn raw survey data into actionable strategies, giving attendees information and a roadmap for leveraging these insights. Experts discussed how brands can adapt to regional preferences, overcome market entry barriers, and capitalize on emerging trends.

Explore the highlights of these events below, and learn how top professionals use data-driven strategies to achieve significant market impact and drive consumer engagement in the plant-based sector.

Italy, Spain and France

As significant European economies, Italy, Spain, and France are also experiencing successful plant-based markets. Italy holds the third-largest plant-based economy in Europe, while Spain and France have the fourth and fifth-largest economies, respectively.

Spain’s key highlights:

- Spanish consumer’s main motivation for reducing meat and dairy consumption is health (47%).

- 52% of people are willing to replace animal-based foods with legumes, and 42% with plant-based dairy products.

- Spain stands out for having the highest trust in plant-based alternatives because of their safety (73%), accurate labeling (71%), and reliability (70%).

- Spain also has the largest share of consumers requesting more government action to support the plant-based market, compared to other countries in the study.

Successful strategies:

Marc Coloma, CEO, Heura Foods, Spain

- Prioritizing scientific research and technology:

- Invest in scientific research and technology to highlight the transformative potential of plant-based materials in the food system.

- Leverage technology, not only to address challenges but also to continually improve products, fostering consumer loyalty through consistent innovation and quality.

- Addressing perceptions of processed foods:

- Communicate the critical role of processing in enhancing plant-based products.

- Develop technologies that not only replicate animal products but also improve upon them.

- Policy advancement:

- Strengthen the plant-based category by presenting a united front and demonstrating its enduring relevance beyond a mere trend.

- Challenge existing policies by showcasing solid, research-backed arguments that emphasize the necessity of transitioning towards plant-based solutions.

Italy’s key highlights:

- 59% of Italian consumers report reducing their annual meat intake, more than any other country and 9% more than in 2021. This change is mostly driven by health concerns.

- 84% report consuming legumes at least occasionally, followed by plant-based fish, milk, and yogurt alternatives, and there’s a clear willingness to incorporate even more.

- 57% of Italian respondents said they are open to substituting animal-based foods with legumes and 43% with legume-based foods.

- 57% of Italian consumers trust plant-based alternatives more than they did three years ago, the highest percentage of consumers among all the countries surveyed. They are most trusted for their safety, accurate labeling, high quality, and reliability.

Successful strategies:

Stephen Tierney, Sales Representative North East Italy, Planted, Italy

- Navigating culinary preferences in Italy:

- Engage Italian consumers by leveraging word-of-mouth and consistently delivering high-quality products.

- Product launch strategy:

- Ensure successful product launches by confirming that production capabilities are robust enough to maintain adequate stock levels.

- Enhancing consumer trust through 360° transparency:

- To gain consumer trust, embed transparency across the company, taking this beyond product quality. Securing recognized certifications, like B Corp, is a great way to do so.

France’s key highlights:

- 58% of French consumers report reducing their annual meat intake, 8% more than in 2021.

- Dietary shifts in France are mostly driven by health (38%), animal welfare (30%), and the environment (29%).

- Legumes are the most familiar plant-based food in France, with 76% of respondents consuming them regularly or occasionally, followed by quinoa (50%) and plant-based fish/seafood (47%). There’s a clear willingness to incorporate even more of these foods.

- 58% say that they use social media to search for information about food products or to get updates on discounts and promotions.

Successful strategies:

Keyvan Mostafavi, Campaign and Advocacy Officer, Aissettes Vegetales, France

- Legislative influence:

- Push for laws to increase the frequency and quality of vegetarian meals in public catering.

- Engagement with school canteens:

- Train chefs and dietitians in plant-based cooking and nutrition.

- Public awareness campaigns:

- Organize events like the ‘Vegan World Tour Week’ to introduce diverse plant-based dishes.

- Partnerships with universities:

- Set and achieve targets for increasing vegetarian meal options in university canteens, aiming for 50% by 2030 (Captain Cause).

Poland and Romania

Poland and Romania are showing significant growth. In both these countries, consumer demand for alternative proteins is expanding rapidly alongside increasing government interest.

Poland’s key highlights:

- 48% of Polish consumers report reducing their annual meat intake, 6% more than in 2021.

- The most important motivator for dietary change in Poland is health.

- Almost 40% of Polish consumers are open to replacing animal-based products with plant-based dairy alternatives and legume-based products.

- Plant-based fish has gained strong momentum in the Polish market, with 65% of respondents reporting at least occasional consumption.

- Discounters are notably important for Polish consumers when purchasing plant-based products, more so than any other surveyed country.

Successful strategies:

Michał Gaszyński, Co-Founder, SERio, Poland

- Standing out in an omnivore market:

- Emphasize innovation over the plant-based label, avoiding ‘vegan’ due to its local stigma.

- Strategically placing a product integrated with traditional options rather than in segregated plant-based sections significantly boosts visibility and attracts new customers.

- Labeling strategy:

- Be creative in your logo and packaging design to engage and delight consumers. For example, SERio’s brand logo creatively combines the Polish words for ‘cheese’ and ‘seriously’ into a playful and memorable wordplay that resonates well with customers.

- Pique consumer curiosity and interest by highlighting unique or trending ingredients on your packaging and labels. For example, SERio showcases ‘lupin’, further attracting attention to their products.

- Consumer education:

- Actively educate new customers through social media channels by creating impactful infographics and trivia that compare plant-based products with animal-based ones. SERio’s content aims to reveal shocking truths to engage and inform viewers. Inspired by other key players in the category (e.g. Oatly), they plan to further enhance their educational campaigns to drive awareness and adoption.

Marcin Tischner, Public Affairs Coordinator & Sustainability Expert, ProVeg Poland

- Policy advancements:

- Unlike many EU countries, there is no VAT disparity between plant-based and animal-based products in Poland. This change was achieved through strong advocacy from various stakeholders to promote dietary equality.

- Collective action:

- Collaborative efforts between non-profits and the food industry have demonstrated that sharing research and opinions and engaging a broad network of stakeholders can effectively influence regulatory outcomes. This strategic approach successfully halted a draft regulation, leading to plans for a roundtable discussion aimed at finding balanced solutions for the industry.

Romania’s key highlights:

- 48% of Romanian consumers claim to have reduced annual meat intake, with the most important motivator for dietary change being health.

- Almost 50% of Romanians are open to replacing animal-based products with legumes.

- Plant-based fish and dairy have gained strong momentum in the Romanian market, with more than 50% of respondents reporting at least occasional consumption.

- 53% of Romanian consumers rely on discounters for purchasing plant-based alternatives.

- Notably, Romania shows a relatively strong endorsement of political action, compared to other European countries.

Successful strategies:

Dorian Macovei, CFO of Verdino Green Foods, Romania

- Meeting consumer preferences:

- Rapid adaptation to consumer preferences is vital. Verdino Green Foods’ shift from fresh to ready-to-eat sausage products led to a tenfold increase in sales, underscoring the importance of aligning with consumer trends for convenience.

- Diversifying protein sources:

- Broadening protein sources beyond traditional alternatives, such as exploring microproteins and precision fermentation, caters to growing demands for sustainable and clean protein sources.

- Clean labeling and local sourcing:

- Prioritize clean labels and local sourcing of new products to match health-conscious trends and improve scalability.

- Locally sourced ingredients boost sustainability, reduce costs, and enhance product relevance.

- Advantages of vertical integration in manufacturing and R&D:

- If available to you, take advantage of in-house manufacturing and R&D teams. Unlike many competitors who rely on a collaborative model with various suppliers, Verdino Green Foods’ in-house manufacturing and R&D capabilities provide a significant competitive edge. Vertical integration allows them to efficiently manage production shifts, ensure reliability, and shorten the supply chain. This setup enables them to quickly design, test, and launch new products, keeping them agile and competitive in the rapidly evolving mainstream market.

- Communication and partnership strategy:

- Prioritize direct communication with end-users through online social media, supplemented by promotions at events, to cultivate strong consumer relationships.

- Collaborate for impact. Significant efforts have been made with Verdino Green Foods’ retail partners to develop the category. By transferring their knowledge from various markets into Romania, they have helped partners enhance their understanding and promotion of this category.

Germany, the Netherlands, and Austria

With some of the most receptive consumer demographics to plant-based foods in Europe, it’s no surprise that Germany, the Netherlands, and Austria are some of the most successful markets.

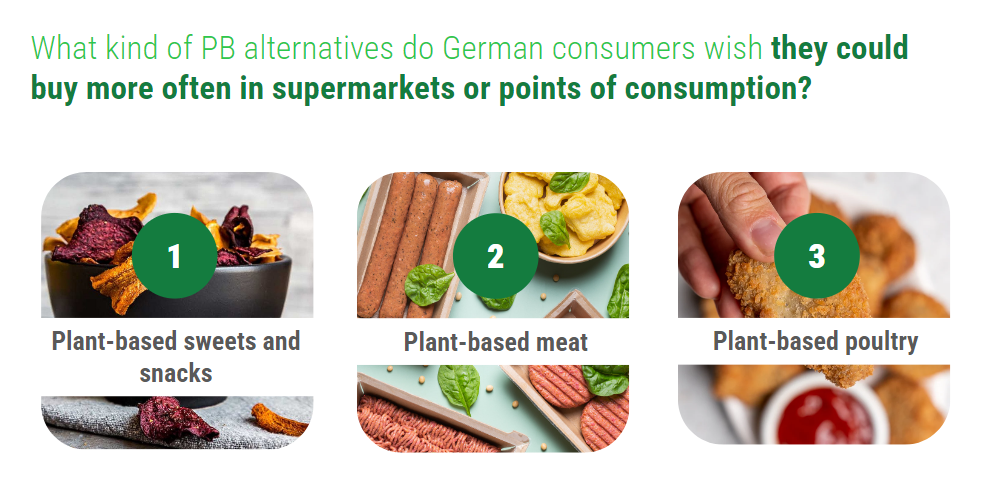

Germany’s key highlights

- Germany has the highest share of flexitarians (40%) out of all European countries surveyed. 10% follow a vegan or vegetarian diet.

- Germany stands out for having one of the highest reductions in yearly meat intake (59%). The main motivation is health concerns.

- Many German consumers plan to replace animal-based foods with legumes (40%) and plant-based dairy alternatives (36%).

- Drugstores are more significant for purchasing plant-based alternatives in Germany than most countries surveyed.

Successful strategies:

Patrick Buehr, Head of Research and Development at Rügenwalder Mühle Carl Müller GmbH & Co. KG, Germany

- Product transparency:

- Ensure ingredient transparency through clear labeling and comprehensive storytelling.

- Switch to a more plant-based ingredient profile. Rügenwalder Mühle Carl Müller GmbH & Co. KG transitioned 60% of its revenue to plant-based products within 10 years while retaining brand consistency.

- Kids’ product range:

- Appeal to families and children. Rügenwalder Mühle Carl Müller GmbH & Co. KG developed a child-friendly range adhering to the World Health Organisation’s salt and sugar guidelines.

- Prioritize nutritional standards and cater to changing consumer needs by offering healthy, appealing options for children.

The Netherlands’ key highlights

- 49% of consumers report reducing their annual meat intake, roughly the same as in 2021 at 48%.

- 35% of consumers follow a flexitarian diet, while 9% identify as vegetarian or vegan.

- Dietary shifts in the Netherlands are primarily driven by health (45%), animal welfare (40%), and environmental concerns (34%), with the country leading in changes motivated by animal welfare.

- Consumers in the Netherlands appear to be happier with the availability of plant-based options than in other countries.

- The Netherlands ranks highest in the acceptance of insect-based protein sources.

Successful strategies:

Martine van Haperen, Expert in food-industry and food service at ProVeg Netherlands

- Protein Tracker:

- ProVeg Netherlands created a standardized system to monitor protein consumption, helping companies identify trends and adjust their protein balance goals. It provides detailed insights into plant versus animal protein sourcing, guiding strategies for protein transitions.

- Public support for policies:

- Surveyed public opinion and found strong support for companies promoting plant-based diets.

- The team also encourages gradual policy changes to promote balanced eating in public institutions.

Karin Lowik, Marketing Director at Vivera, The Netherlands

- Quality focus:

- Run frequent testing of plant-based products against competitors and meat to achieve high standards. With this in mind, Vivera implements regular quality improvements to ensure consistent consumer satisfaction and brand loyalty.

- Sustainability and B Corp certification:

- Embed sustainability into all facets of business operations. Vivera achieved a B Corp certification in doing so.

- Engage employees in creative brainstorming. Vivera involved employees through canteen sessions to generate innovative ideas that align with consumer values.

Austria’s key highlights

- 51% of Austrian consumers report reducing their annual meat intake, mostly driven by health concerns.

- Austria has the second-highest share of flexitarians (37%) of the surveyed countries, and the largest share of vegans (5%). Additionally, there has been a notable decrease in the number of omnivores.

- Compared to other countries, Austrians are especially reducing pork (37%) and milk consumption (10%).

- Austrian consumers struggle the least with the taste of plant-based alternatives.

- Austria appears to be happier with the availability of plant-based options compared to the other countries and leads in the acceptance and consumption of fungi-based protein sources.

Successful strategies:

Verena Wiederkehr, Head of Plant-Based Business Development at Billa AG, Austria

- Pricing and accessibility:

- Match the price of plant-based products with animal-based ones to make them more accessible and attractive to Austrian consumers. Billa lowered the prices of its VegaVita line to match or undercut animal-based products, leading to a 47% increase in sales volume.

- Transparent communication:

- Use ‘plant-based’ instead of ‘vegan’ to broaden product appeal and change consumer perceptions.

- Implement the recognizable V-label to identify plant-based products and improve customer trust.

- Billa Pflanzilla store:

- Austria’s first fully plant-based supermarket served as a flagship model to promote innovation and accessibility while testing new products, giving startups and smaller companies a platform.

Denmark and the UK

Denmark is making strides in promoting sustainable and plant-based food options, and there is notable consumer interest and government support for sustainable food initiatives. Meanwhile, the UK is seen as one of the largest plant-based economies in Europe, with a blossoming plant-based economy and a growing flexitarian demographic.

Denmark key highlights

- 48% of Danish consumers report reducing their annual meat intake, which is 7% more than in 2021.

- The most important motivators for dietary change are health and the environment.

- 42% of Danish consumers intend to replace animal-based products with legume-based alternatives and plant-based dairy alternatives.

- Denmark stands out with the most consumers who have incorporated plant-based meats into their regular eating habits (32% on average).

- 49% of respondents trust plant-based alternatives more than they did three years ago, mostly due to safety and accurate labelling.

- Denmark ranks the highest for acceptance of cultivated protein sources of all surveyed countries.

Successful strategies:

Rune-Christoffer Dragsdahl, Secretary-General at the Vegetarian Society of Denmark

- National plant-based food action plan:

- Leverage government support for a national plan that provides funding and policy initiatives aimed at increasing plant-based food consumption.

- Industry collaboration:

- Encourage cooperation among plant-based businesses, organic food producers, and farmers to create a unified network.

- Join the Plant-Based Business Association to build a collaborative industry that aligns its goals with government policies.

- Public education and awareness:

- Promote plant-based diets through collaborations with educational institutions, chefs, and nutritionists.

- Establish public-private partnerships to foster greater transparency and address misconceptions about processed plant-based foods.

The UK’s key highlights

- 48% of consumers in the UK have reduced their annual meat intake, 11% more than in 2021.

- The most important motivator for dietary change is health (48%).

- The UK has the largest number of vegetarians (7%) among the surveyed countries.

- 49% of British consumers trust plant-based alternatives more than three years ago, mostly due to safety and accurate labelling.

- 57% of consumers are open to replacing animal-based products with legumes.

- Notably, the UK shows one of the strongest endorsements of political action, compared to other European countries.

- 64% of consumers support policies to increase consumption of plant-based meals.

Successful strategies:

Mike Hill, Founder and Director of Active Insight at One Planet Pizza, the UK

- Sustainability and transparency:

- Implement carbon labeling on plant-based products to align with growing consumer demands for sustainability. One Planet Pizza recently added such labels to their pizza boxes, with great success.

- Promote transparent sourcing by shifting to ingredients that minimize environmental impact. One Planet Pizza has switched from coconut to soya-based cheese for this very reason.

- Market focus and storytelling:

- Narrow your product range to focus on a few high-quality flavors that resonate with consumers.

- Tell a brand story to help consumers engage with your company on a more personal level. For example, One Planet Pizza uses its father-son brand story to humanize the company and connect with customers seeking authenticity.

- Consumer insights and supermarket collaboration:

- Research and understand consumers’ needs to develop products that meet UK consumers’ priority dietary motivations – health and taste. One Planet Pizza undertake comprehensive research to create pizzas that meet health and taste preferences.

- Work with supermarkets to educate buyers on plant-based products’ commercial and ethical value, gaining more shelf space in return.

The Smart Protein country-level reports and webinars have successfully laid down a framework for understanding and making the most of the burgeoning potential of the plant-based industry – in 10 of the most important markets for plant-based eating in Europe. As this economic sector grows, insights like these will undoubtedly play a pivotal role in shaping the future strategies of businesses across Europe.